Contents

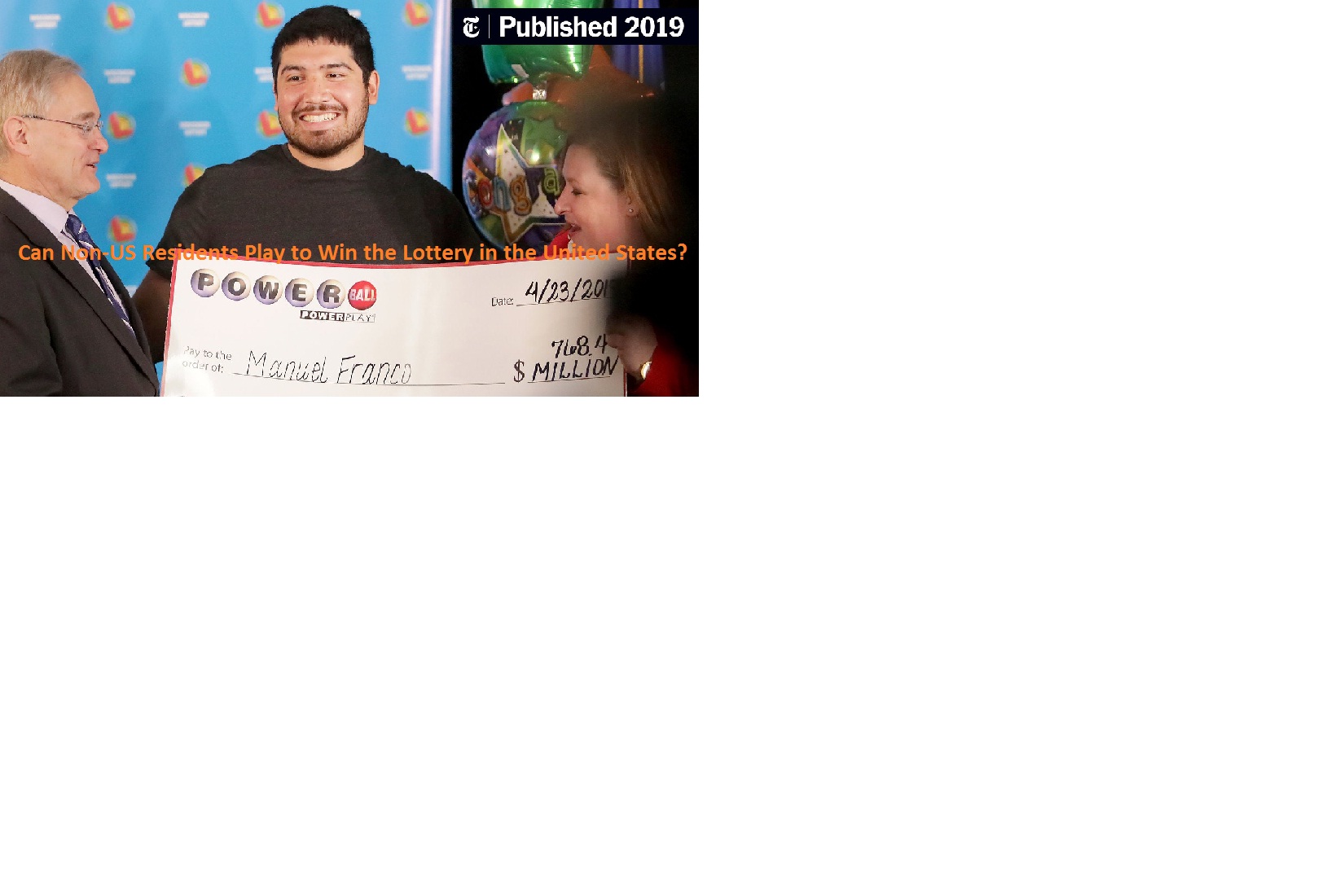

Can Non-US Residents Play to Win the Lottery in the United States?

The allure of winning the lottery is universal, and many people dream of hitting the jackpot and changing their lives overnight. But what if you’re not a resident of the United States? Can non-US residents participate in the US lottery and have a chance at winning? In this article, we will explore the rules and regulations surrounding non-US residents playing the lottery in the United States. We’ll provide you with all the information you need to know, so let’s dive in!

Can Non-US Residents Play to Win the Lottery in the United States?

Yes, non-US residents can play the lottery in the United States. However, the rules and regulations may vary depending on the specific lottery game and state in which it is offered. It’s important to understand the requirements and restrictions before purchasing a ticket. Let’s take a closer look at some key aspects related to non-US residents participating in the US lottery.

1. Understanding the Different Lottery Games

The United States offers various lottery games, including Powerball, Mega Millions, and state-specific lotteries. Each game has its own set of rules and regulations. Before buying a ticket, it’s essential to research and understand the specific requirements for non-US residents.

2. State-Specific Rules

In the United States, lottery regulations are determined at the state level. This means that each state has the authority to establish its own rules regarding who can play and claim prizes. Some states allow non-US residents to participate, while others may have restrictions. It’s crucial to check the rules of the particular state in which you plan to play.

3. Purchasing Lottery Tickets

Non-US residents can purchase lottery tickets while visiting the United States. It’s important to note that lottery tickets cannot be purchased online from outside the country. If you are a non-US resident, you must physically be in the United States to buy a ticket. Remember to bring proper identification, such as a passport, as it may be required to claim any winnings.

4. Tax Obligations for Non-US Residents

If you are a non-US resident and win a lottery prize in the United States, you may be subject to federal withholding taxes. The Internal Revenue Service (IRS) requires a 30% withholding on lottery winnings above a certain threshold. However, some countries have tax treaties with the United States that may reduce or eliminate this withholding. It’s advisable to consult with a tax professional in your country of residence to understand the potential tax implications.

5. Claiming Prizes

If you are a non-US resident and win a lottery prize, the claiming process may differ from that of US residents. Some states allow non-US residents to claim prizes, while others may have specific requirements or restrictions. It’s essential to contact the lottery commission of the state where you purchased the ticket to understand the procedures for claiming your prize.

Conclusion

While non-US residents can indeed play the lottery in the United States, it’s important to understand the specific rules and regulations of the state and game in which you wish to participate. Lottery rules can vary, and tax obligations may apply to non-US residents who win prizes. If you’re a non-US resident dreaming of winning the US lottery, make sure to do your research and enjoy the thrill responsibly. Good luck.

FAQs:Can Non-US Residents Play to Win the Lottery in the United States?

Q1: Can non-US residents participate in Powerball? Yes, non-US residents can participate in Powerball as long as they purchase a ticket in person while they are physically present in the United States.

Q2: Are the rules the same for Mega Millions and state-specific lotteries? The rules may vary for Mega Millions and state-specific lotteries. It’s important to check the rules of the particular game and state in which you wish to participate.

Q3: Do non-US residents have to pay taxes on their winnings? Non-US residents may be subject to federal withholding taxes on their lottery winnings. However, tax obligations may vary depending on the country of residence and any tax treaties in place.

Q4: Can non-US residents claim their prizes from outside the United States? In most cases, non-US residents must be physically present in the United States to claim their lottery prizes. However, it’s best to check the specific rules of the state where the ticket was purchased.

Q5: Can non-US residents participate in online lottery games? Non-US residents cannot participate in online lottery games offered by US lotteries. Tickets must be purchased in person while physically present in the United States.

Q6: What should non-US residents do if they win a lottery prize? If a non-US resident wins a lottery prize, they should contact the lottery commission of the state where the ticket was purchased for guidance on claiming the prize.